Healthcare Provider Dramatically Improves Vendor Risk Management

The Customer Implemented Solution Within Three Months, Increasing Yearly Assessments by 373%

A large healthcare provider was conducting hundreds of assessments a year via email requests, manual surveys, and spreadsheets. They were concerned because they were only able to assess a small percentage of their vendor ecosystem using a highly manual process. Getting surveys completed properly and on time was a persistent challenge. If a vendor was considered a risk, the subsequent follow up was very time-consuming.

The company wanted to automate the entire process: data gathering, notifications, risk scoring, analysis, and remediation. They needed an enterprise solution that could bring this information together to help them determine which vendors pose the greatest combined risk. Additionally, they wanted to integrate third-party intelligence so they could understand what happens if a vendor moves to a high-risk location or has financial viability issues. Finally, the company wanted to leverage their existing workflow processes and data from legacy systems.

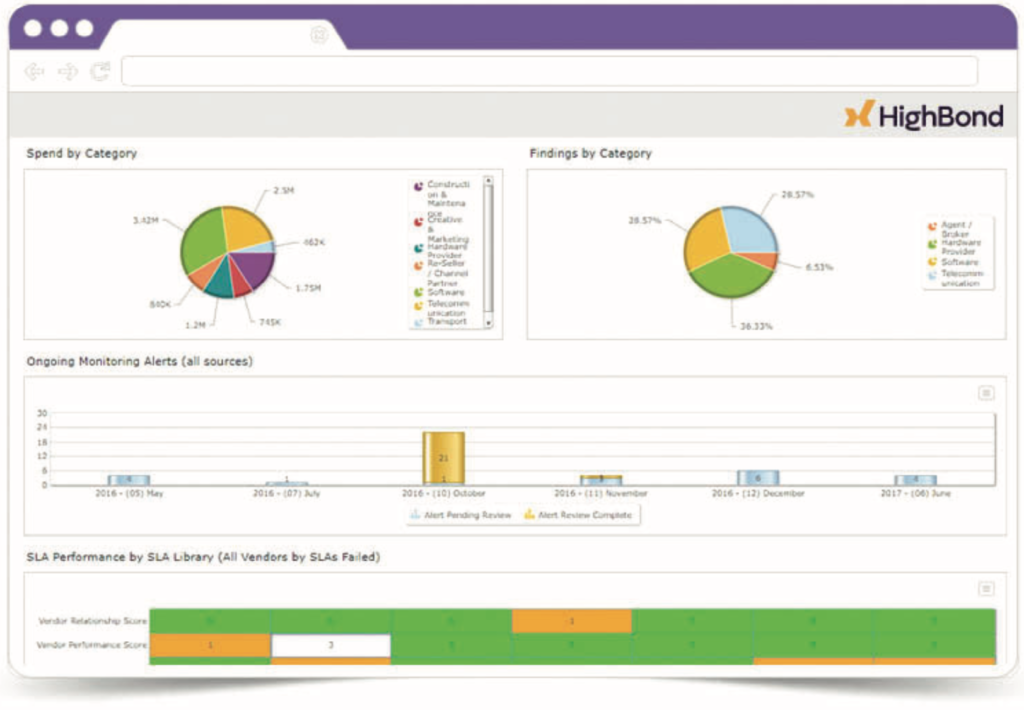

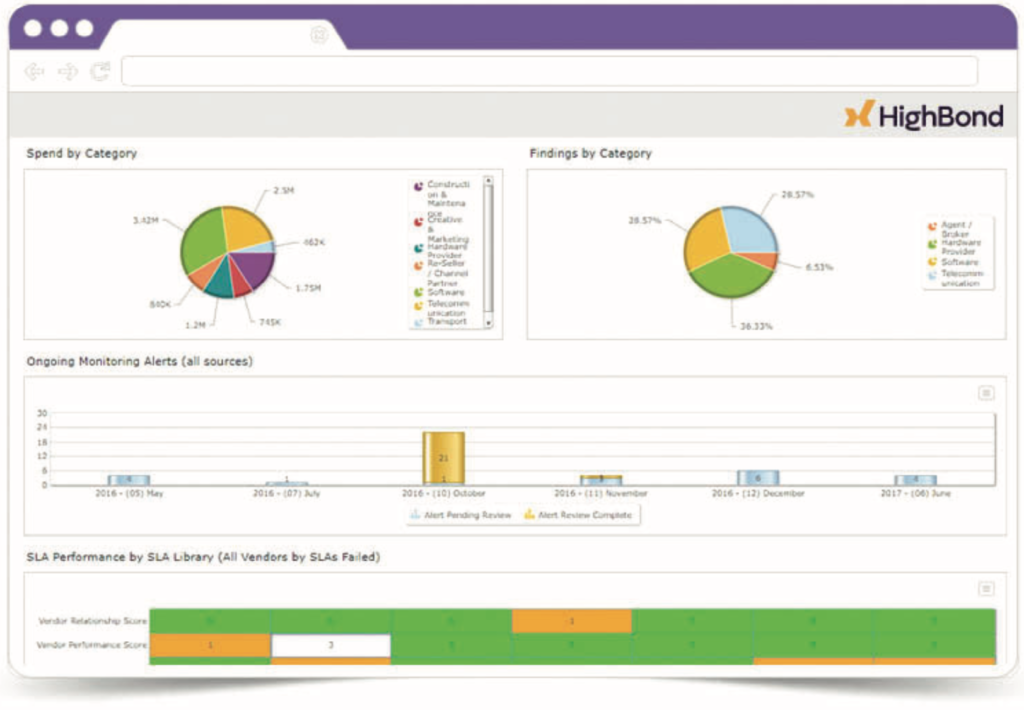

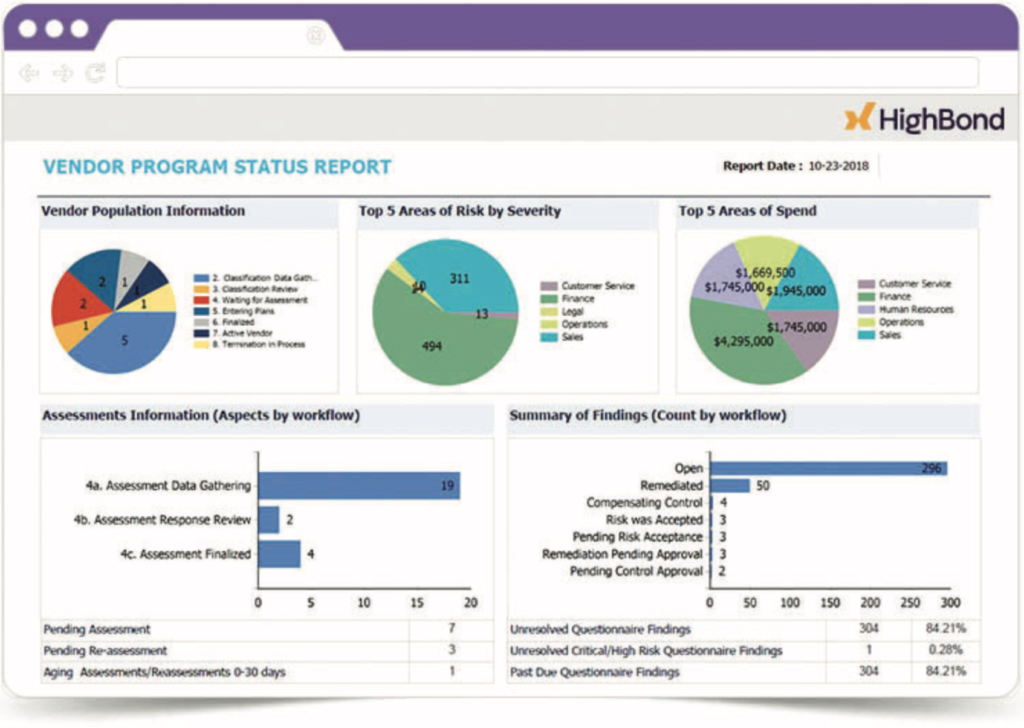

ThirdPartyBond tracks all aspects of your vendor and creates a risk score

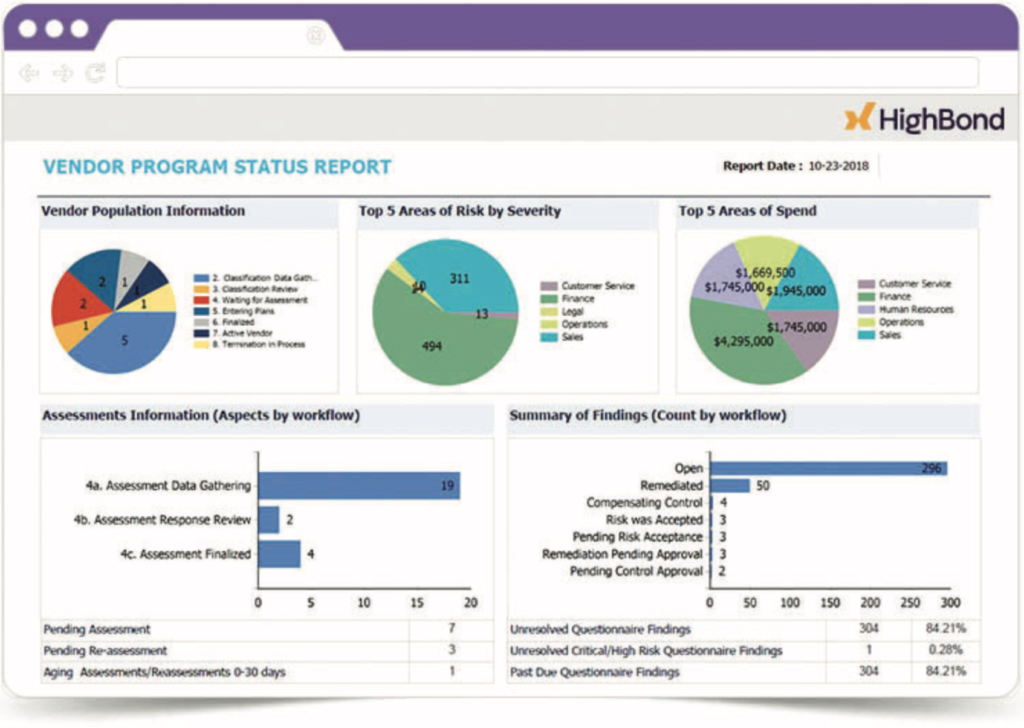

ThirdPartyBond creates a central repository for tracking vendor assessments and gap analysis

- ThirdPartyBond Effect

Solution

The customer selected ThirdPartyBond. Their use case included control-based assessments with questionnaire findings for gaps. It supports self-registration for initial full assessments for internal and external vendors, initial partial assessments for internal vendors, annual vendor assessments, and software-only assessments. The Galvanize Client Partner worked closely with the company to incorporate processes unique to them. For example, the platform includes a database, which allows users to select who needs to participate in Tier 1 assessments, such as business unit executives. After an assessment is successfully completed, reviewed, and approved, an internal risk memo is automatically generated communicating the status to stakeholders.

- Results

The solution was implemented in three months thanks to the customer’s well-defined processes. Since the assessment module went live, the company increased the number of yearly assessments they were able to complete by 373%. If an assessment is determined to be low risk, ThirdPartyBond automatically generates a memo to internal stakeholders indicating the status. Meanwhile, high-risk assessments are escalated for action.

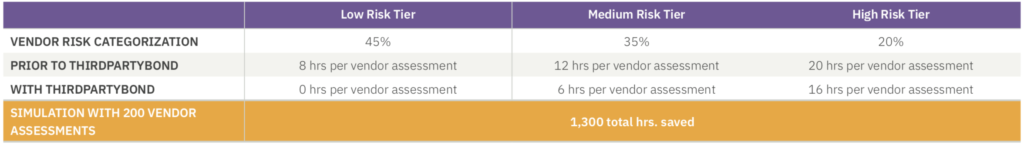

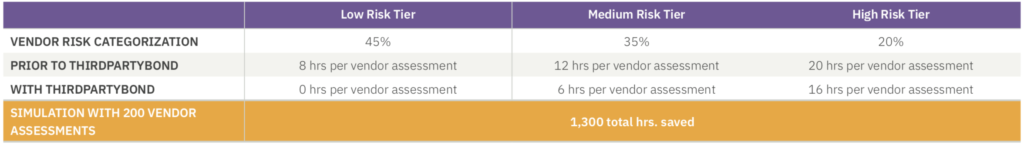

- Time Saved Using ThirdPartyBond for Assessments

Since implementing ThirdPartyBond, the company has been able to automate an extremely manual assessment process, eliminating multiple spreadsheets and time-consuming follow ups and delays.

Peningkatan Signifikan Manajemen Risiko Oleh Penyedia Jasa Kesehatan

Klien Mengimplementasikan Solusi dalam Tiga Bulan & Penilaian Tahunan Meningkat Hingga 373%

Setiap tahunnya para perusahaan besar penyedia jasa kesehatan melakukan ratusan penilaian atas permintaan melalui surat elektronik/e-mail, survey, maupun pengolahan data informasi dikomputer. Hal yang menjadi kekhawatiran mereka ialah minimnya persentase vendor yang dapat terserap karena banyaknya proses kerja dilakukan secara manual. Melakukan survey dengan tepat dan menyelesaikannya tepat waktu ialah hal yang terus menerus menjadi tantangan tersendiri. Apabila vendor dinilai berisiko tinggi, maka tindak lanjutnya menjadi sangat menyita waktu.

Perusahaan ingin melakukan otomatisasi atas seluruh rangkaian proses kerja; pengumpulan data, pemberitahuan, penilaian risiko, analisis, hingga tindakan pemulihan/perbaikan.

Mereka membutuhkan solusi perusahaan yang dapat menyatukan informasi ini untuk membantu mereka menentukan vendor dengan potensi risiko terbesar/tertinggi. Selain itu, mereka ingin mengintegrasikan intelijensi pihak ketiga sehingga mereka dapat memahami apa yang terjadi apabila vendor berpindah ke lokasi dengan risiko tinggi atau memiliki masalah kemampuan finansial. Perusahaan juga ingin memanfaatkan alur kerja dan data yang sudah ada dari sistem sebelumnya.

ThirdPartyBond/pihak ketiga melacak atau mencari tahu seluruh aspek vendor anda dan membuat skor/nilai atas risiko.

ThirdPartyBond/pihak ketiga membuat fitur penyimpanan terpusat untuk melacak penilaian vendor dan analisis atas komparasi/perbandingan.

- ThirdPartyBond/pihak ketiga efek/dampak

Solusi/Penyelesaian Masalah

Klien memilih ThirdPartyBond. Mereka merujuk pada masalah/kasus klien termasuk penilaian berbasis kendali dengan daftar pertanyaan untuk menemukan celah. Hal ini didukung dengan fitu pendaftaran mandiri untuk penilaian pertama baik untuk vendor internal maupun eksternal, penilaian parsial untuk vendor internal, penilaian tahunan, dan penilaian perangkat lunak. The Galvanize Client Partner bekerja sama dengan perusahaan untuk membentuk proses kerja yang spesifik untuk mereka. Contohnya, platform termasuk sumber data, yang memungkinkan pengguna untuk memilih partisipan pada tahap pertama penilaian, seperti Business Unit Executives. Setelah penilaian berhasil diselesaikan, diperiksa, dan disetujui, memo risiko internal secara otomatis dibuat/dikeluarkan untuk menginformasikan status kepada pemangku kepentingan.

- Hasil

Solusi diimplementasikan dalam waktu tiga bulan berkat klien yang menyampaikan keinginannya dengan jelas dan rinci selama proses pengerjaan. Sejak modul penilaian secara aktif digunakan, perusahaan mengalami peningkatan dalam proses penilaian tahunan yang mampu diselesaikan hingga 373%. Apabila penilaian menyatakan bahwa risiko kecil atau rendah, ThirdPartyBond akan secara otomatis mengeluarkan memo untuk pemangku kepentingan internal perusahaan yang menyatakan status atau hasil penilaian. Di lain pihak, penilaian dengan hasil risiko tinggi akan secara otomatis diteruskan untuk tindakan/tahapan selanjutnya.

- Waktu yang digunakan untuk proses penilaian menjadi lebih efisien menggunakan ThirdPartyBond

Sejak mengimplementasikan ThirdPartyBond, perusahaan berhasil melakukan otomatisasi atas proses penilaian, menghilangkan beberapa pengolahan data yang sangat manual dan menyita waktu dalam pengerjaannya serta kerap menimbulkan keterlambatan.